Gas prices in Europe are at record highs, and European politicians accuse Gazprom of blackmail. Vladimir Milov explains what is behind the European energy crisis and what the Kremlin has to do with it, as well as whether it is possible for Europe now to speed up its transition to green energy – a threat Russia should take seriously.

Why has the price of gas gone up so much?

First of all, a few words about the causes of the current price crisis in Europe. There are, indeed, objective factors at the heart of it - the easiest way to describe them is by using the phrase «it happens». Markets move in fits and starts periodically, and in a modern market economy it is necessary to get used to this and to develop tools to hedge risks. The flip side of today's price surge is last year's steep decline - when the pandemic crisis caused European gas prices to plummet, reaching the levels seen 20 years earlier.

The average imported gas price in Germany was $145 per thousand cubic meters in 2020, the average price at the Dutch TTF hub was even lower, around $100. Then came the cold winter (and, consequently, gas was pumped from underground storage facilities at a higher rate), which coincided with the unexpectedly rapid post-covid recovery of Asian economies and the growth of gas consumption in Asia. In fact, Asia remains the main price growth driver today - prices there have reached $1,500 per thousand cubic meters, which is much higher than in Europe.

The main gas price growth driver is Asia, where economies are recovering very quickly from the pandemic

The natural gas market has rapidly globalized in recent decades due to the development of liquefied natural gas (LNG) transportation. On the one hand, it is convenient - the development of LNG infrastructure makes consumers less dependent on the traditional pipeline monopolists like Gazprom and gives them the flexibility and opportunity to choose a brand-new supplier. On the other hand, the flexible LNG market is fraught with situations like today’s – should prices skyrocket in a particular market segment, all the suppliers rush over, creating a deficit in the other segments.

That is exactly what happened in recent months - a cold winter and rising prices in Asia emptied the European storage facilities, making it unprofitable for suppliers to fill them and causing gas to flow into Asia, where profits were much higher. There were also other reasons - problems with gas production in Norway, lack of wind for offshore wind farms in the North Sea - but they hardly mattered, with Asian demand playing the main role (in fact, European prices tend to catch up with Asian ones). As the winter of 2021-2022 approached, the market started to worry - gas storage volumes were at an all-time low, creating serious fears of physical gas shortages in the cold winter months.

What does Gazprom have to do with it?

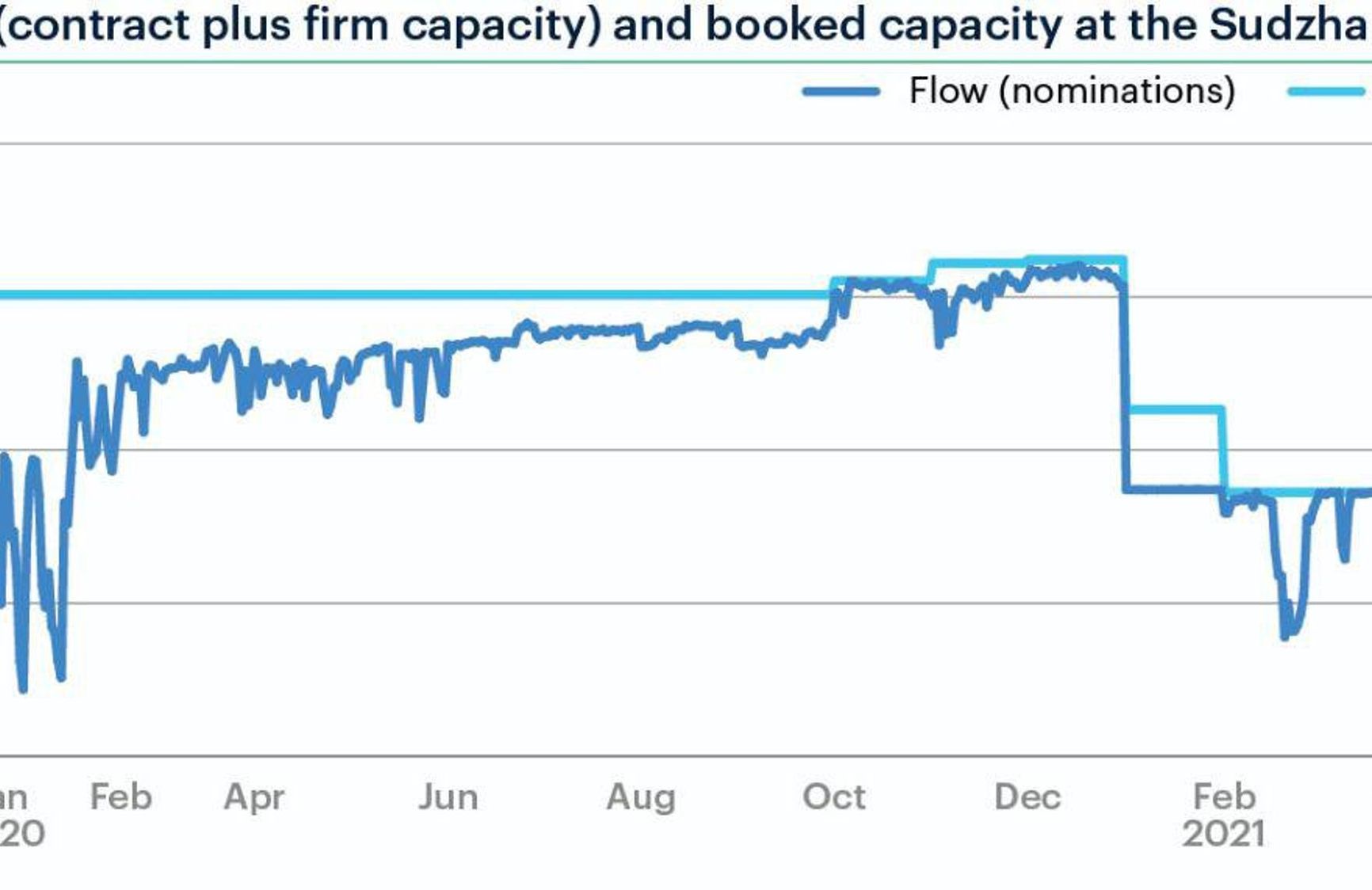

But this is only the objective, a fundamental part of the picture. There is also a hidden one, related to Gazprom's blatant manipulation of the market. Sensing the impending price storm in the European market, the Russian monopoly decided to pour fuel on the fire by taking the stance «we stand by our firm contractual obligations» and de facto refusing from June to fulfill additional requests from consumers and reserve additional pipeline capacity through Ukraine and Poland. You can see what it looks like in the chart below:

(source)

At the same time, Gazprom is fully able to extract and sell gas – as early as last summer there were headlines in the Russian press like «Gazprom to hold back gas». An anti-monopoly investigation, which was demanded several weeks ago by a group of MEPs, would have helped to accurately establish the existence of spare capacity – an artificial creation of a deficit for the sake of increasing prices is a classic case of violation of both Russian and European anti-monopoly laws. To clarify: Gazprom does own its gas, but to have access to the world's largest gas market in Europe, it must abide by the rules of fair competition. The Europeans did not ask the Russian monopoly to give away gas for free, they offered a record-high market price for it, but Gazprom refused to supply additional volumes. Thus, while there are underlying reasons for the crisis, Gazprom has, through its deliberate actions, fanned the flames even further. Of course, these actions were based not only on the desire to earn extra money, but also to pressure the Europeans into being more cooperative in allowing the launch of Nord Stream-2.

«Gazprom» refused to sell more gas, thus fanning the price flames even further

So far, the European Commission has been reacting cautiously and is in no hurry to open an antitrust investigation. But, whether this happens, voices in Europe have already begun to be heard calling for a rapid shift away from dependence on Russian gas. Is this possible?

What can Europe do?

The shift will happen in the long run - Europe has set a goal of bringing its share of renewable energy to 40% in final consumption by 2030, and one way or another that goal will be met. But the energy sector is highly inertial and capital-intensive, and such things are not done quickly. Renewable energy is already developing in Europe by leaps and bounds from the energy sector's perspective. Just ten years ago, according to BP’s Statistical Review of World Energy, the share of renewable energy in the EU's primary energy consumption was about 6%, and it is as high as 12.5% in 2020. Today renewable energy sources account for 26% of electricity generation, while nuclear power and natural gas account for 25% and 20% respectively.

However, the situation is complicated by the fact that such a breakthrough in renewable energy has not happened everywhere. Germany has made the most progress here, with the share of renewable sources in electricity generation being 41% in 2020 (while natural gas accounted for only 16%); the share of coal decreased from 51% in 2000 to 24% now). But rapid progress is largely limited to Germany: this country now produces a third of all European electricity from renewable sources, while the situation in the other states lags far behind. For example, natural gas accounts for about 50% of electricity generation in Italy, 60% in the Netherlands, while renewable sources account for merely a quarter. In fact, the EU has no common energy policy.

Only Germany has seen rapid progress in renewable energy sources

But the bad news for Gazprom is that the current autumn/winter price crisis will only accelerate the energy transition. The political consequences for the EU are too significant: temporary shutdown of businesses due to excessive growth in energy prices, a spike in inflation. Such a crisis has not happened for a long time, and it will undoubtedly have political repercussions. European governments are already actively raising the issue of a systemic response to prevent such crises in the future.

So far, we can only speculate as to what such a response might be, but two things are already clear. Firstly, the reputation of natural gas as a «transition fuel» (a little bit more environmentally friendly and climate-neutral than coal and oil) has suffered greatly - it has suddenly become clear that for Europe the transition to green energy is not just a question of climate, it is also a question of being able to reduce the rather painful dependence on suppliers of conventional energy products. And this will likely mean an additional set of measures to support the transition to renewable energy.

And secondly, Gazprom may face a whole range of additional negative consequences - for example, it has accumulated a large underground gas storage capacity in the EU, but now it may be declared a sensitive market infrastructure and Gazprom will be forced to sell its storage facilities, just as gas suppliers were previously forced to give up ownership of pipelines. Or the Europeans will make Gazprom renegotiate its gas contracts to make additional supplies more affordable - in the past they repeatedly succeeded in pressuring Gazprom into renegotiating contract terms.

All in all, as was often the case, Gazprom and Putin tried to achieve a tactical gain by exploiting the problems on the European gas market by using the gas deficit for blackmail and pressure, but they are likely to lose strategically. The reputational costs of the undeclared gas war against Europe are enormous – although its fundamental causes are different, Gazprom could help to ease supply tensions and make good money on it. It chose to increase the pressure - for obvious political reasons. This will most likely backfire in the end - Europe will take steps to avoid such blackmail in the future.

Русская версия - здесь